Първоначално изпратено от segato

Разгледай мнение

Съобщение

Collapse

No announcement yet.

Какво поскъпване очаквате на жилищните имоти?

Collapse

X

-

края на годината лихвите може и да намалеят", обясни той.

https://blitz.bg/ikonomika/eksperti-...ews946683.html

- 1 like

Коментар

-

Тук яицата май са си на същите цени като 2020. 4-5 кинта за 12. И да не са , няма драма , зашото са евтини. Не знам каква е тази истерия с яйцата в България, но ми изглежда странно да е проблем след като "банките са пълни с депозити"Първоначално изпратено от Конан-Варварина Разгледай мнение

Значи е време и яйцата да паднат обратно на 10ст. /бой по кокошките/. Само заплатите да не пипат.

- 1 like

Коментар

-

Хората вероятно не си дават сметка , но средната цена на имоти в Чехия е по-висока например от Белгия и Германия. Прага и Бърно са драйверите. България пък винаги е била на дъното по цени в Европа. Не в ЕС а в Европа. Борим се с Черна Гора и макетата за най-ниски цени. Та ако сме стигнали да сравняваме Прага със София, значи или София много е дръпнала в последните 3-4 години, или много хора не се лекуват. Как мислите , София дръпнала ли е ?Първоначално изпратено от antani Разгледай мнение

Аз нямам против и да продължат да се качват. В Прага имотите вече са 20% надолу и почти са изравнени със Софето. Скоро ще има трампене на имоти в София за имот в чужбина. Още 10% спад в Прага и 5% ръст в София и почвам да разпродавам . Пък нека други стискат до 2039.

. Пък нека други стискат до 2039.

Коментар

-

Глупости, то бива да сте out of touch, ма Вие стигате до фазата при която човек почва да се чуди дали ше оцелеете. Имотите тук са паднали с около 30% от Април-Май миналата година. Вие оше навивате махалото. Като стане това което всички знаем , че ше стане, кажете едно мерси на БНБ . Благодарение на тях ше бъде късно , но пък за сметка на това унищожително. И преди съм казвал, при 40% инфлация , да не вземат мерки е престъпление. Да , знам че лихвите по кредитите се определят и от тези по депозитите, но това означава просто , че банковата система е шит. Банките отдавна трябваше да бъдат разследвани за картел. Ниските лихви по депозитите и необясними такси ги няма никъде.Първоначално изпратено от pinoccio Разгледай мнение

Номиналът вече нищо не означава освен някаква котировка. Колкото можеш да прецениш защо и как се движат цените на борсата, толкоз това е възможно и в имотите. Сега е пълна финансова бъркотия - комунизъм за банките, феодализъм за хората. Ако имаш кеш - изтръскай го и си вземи нещо, докато е време. У нас, за разлика от затъналия в заеми останал свят, 100 млрд. лева дремат в дюшеците и хората ги извадиха, защото виждат задаващият се финансов апокалипсис. Затова има такива обяви, ще има и още по-интригуващи.

С банки или не, България не може да стане по-скъпа от Хърватска или Румъния. Въобще да не говорим за Белгия и Чехия Тия приказки за шума са леко преувеличени ако със съшата тази шума можеш да вземеш апартамент в центъра на Загреб за 3-4к. Абе какъв Загреб, за 6к ше вземеш апартамент в Carré d'Or в Ница бе. и даже ще има асансьор (представяш ли си ?)

- 1 like

Коментар

-

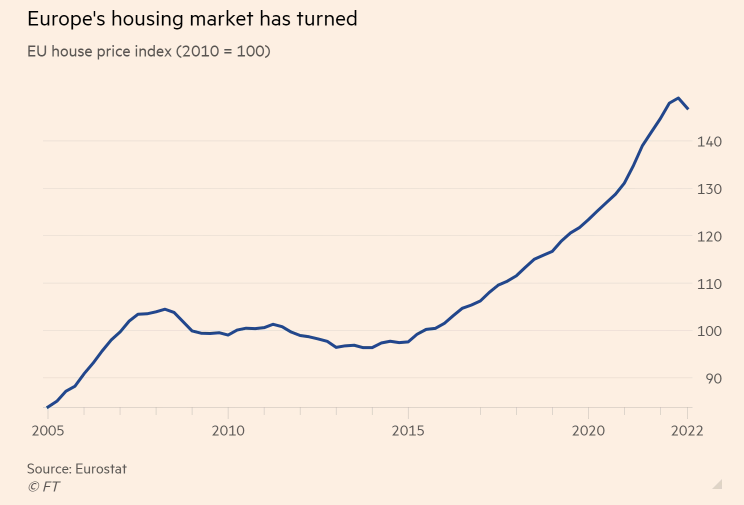

https://www.ft.com/content/309d5a00-...7-41563f1cb16b

До оня ден Кристалинка Ви канеше да харчите ,сега друга песен запя

Коментар

-

Как видя IP адреса ми? Модератор ли си? Между другото в Карлово почти не се виждат вече кокошки из дворовете.Първоначално изпратено от ratten Разгледай мнение

няма, няма, тук ще падат с по толко....на месец

мерено в яйца от свободни карловски кокошки

Коментар

-

Кой не е добре, ситуацията или продавача ? Какво да му чакам на пазара ? Ако не виждате колко абсурдно е всичко ...Първоначално изпратено от Дюри Разгледай мнение

Веднага ти казвам- Не е добре Да видим пазара как ще приеме тази цена защото той е важен.

Да видим пазара как ще приеме тази цена защото той е важен.

Коментар

-

няма, няма, тук ще падат с по толко....на месецПървоначално изпратено от Конан-Варварина Разгледай мнение

15% е много за БГ, тук сме остров на стабилност и цените няма да растат с подобни темпове

мерено в яйца от свободни карловски кокошкипрепоръка е

Коментар

-

15% е много за БГ, тук сме остров на стабилност и цените няма да растат с подобни темповеПървоначално изпратено от ratten Разгледай мнениее, на, пак брокерски полюции Цените на строителството в Германия продължават да растат

През февруари цените в строителството са с 15% по-високи от тези преди година. Това се дължи главно на повишените разходи за материали

макар, че много ми прилича на рубриката

днес там, утре...не се знае къде

Коментар

-

яйцата са основата на имотите, много от майсторите хапват пържени филийки с яйца, а вдигнат ли се яйцата, майсторите автоматично захвърлят кирките и лопатите и искат по-висок надник.Първоначално изпратено от Laconic Разгледай мнение

Не е чак толкова просто, но е за умни хора!

Тези имоти от яйца ли ги правите? Ей, много акъл има в тази глава повдигаческа!

Коментар

-

Викаш ,стойността на шумата не може да е част от уравнението . Таргета е стойност на шумата надолУ активи и те надолУ и плебея цар ! Утопично ми се вижда това търсене ....Първоначално изпратено от Laconic Разгледай мнение

Не е чак толкова просто, но е за умни хора!

Тези имоти от яйца ли ги правите? Ей, много акъл има в тази глава повдигаческа!

Коментар

Коментар