Кризи-дългове. Страшно. И все пак.

Вчера се запитах: А защо маса правителства допускат толкова дълбоко задлъжняване?

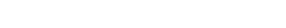

И тутакси се яви абсурден образ. Представете си, балон /икономиката/. Тази икономика, сили като материалното производство и паричната маса се опитват да я раздуят. И нещо би трябвало да я удържа в цялост, да не позволява да се накъса на парчета и да се разлети наляво-надясно. В тази картинка, задлъжняването се явява като предпазен клапан. Нещо като да работи, образувайки вътрешен вакуум. Така, при ограничена еластичност в лицето на пазарни взаимовръзки, се създава нещо, което никой друг не би желал да има. Т.е., един вид, омега-стратегия: Ако искаш да запазиш едно перце във въздуха, да не отлети при комшиите, вместо да го връзваш с конец, му пускаш насрещен вятър. Е, кой би искал да купи - примерно, макар да е краен примерът - американската икономика като цяло при положение, че е така натоварена с дългове? Не за 50 трилиона, за 50милиарда няма да я искат с такъв баланс. Извратено обаче, работи. При къде по-ниски степени задлъжняване, Япония и Китай, са станали основни външни кредитори. Щото са вярвали, че има далавера. И е вярно само че, далавера вътре в САЩ, в сравнение с вътрешни компании. Вероятно, тогава са се замисляли, какво ще е "да купиш цялата Америка". Днес, едва ли го правят. Представете си ги като плувци: Плувец може да натовари върху себе си само ограничена тежест, после сам потъва. Е, натоварили са се, и вече няма нужда. Изнесли са маса производства навън, Америка не може да си купува сама своите продукти, затова внася от Китай /примерно/, гащи.

И става "наша, напук на всичко".

АКО същата тази Америка се издължи по всички дългове /навън, не към ФЕД/ то, всяка нова печалба става в пъти по-привлекателна, и пак светът ще почне да се натиска да ги изкупи.

Какво следва от всичко това извратено разбиране ли?

Как да ви кажа, допускам много плавно спускане и на Китай в подобна дългова спирала. Вероятно, и до нови Дълбини.

Вчера се запитах: А защо маса правителства допускат толкова дълбоко задлъжняване?

И тутакси се яви абсурден образ. Представете си, балон /икономиката/. Тази икономика, сили като материалното производство и паричната маса се опитват да я раздуят. И нещо би трябвало да я удържа в цялост, да не позволява да се накъса на парчета и да се разлети наляво-надясно. В тази картинка, задлъжняването се явява като предпазен клапан. Нещо като да работи, образувайки вътрешен вакуум. Така, при ограничена еластичност в лицето на пазарни взаимовръзки, се създава нещо, което никой друг не би желал да има. Т.е., един вид, омега-стратегия: Ако искаш да запазиш едно перце във въздуха, да не отлети при комшиите, вместо да го връзваш с конец, му пускаш насрещен вятър. Е, кой би искал да купи - примерно, макар да е краен примерът - американската икономика като цяло при положение, че е така натоварена с дългове? Не за 50 трилиона, за 50милиарда няма да я искат с такъв баланс. Извратено обаче, работи. При къде по-ниски степени задлъжняване, Япония и Китай, са станали основни външни кредитори. Щото са вярвали, че има далавера. И е вярно само че, далавера вътре в САЩ, в сравнение с вътрешни компании. Вероятно, тогава са се замисляли, какво ще е "да купиш цялата Америка". Днес, едва ли го правят. Представете си ги като плувци: Плувец може да натовари върху себе си само ограничена тежест, после сам потъва. Е, натоварили са се, и вече няма нужда. Изнесли са маса производства навън, Америка не може да си купува сама своите продукти, затова внася от Китай /примерно/, гащи.

И става "наша, напук на всичко".

АКО същата тази Америка се издължи по всички дългове /навън, не към ФЕД/ то, всяка нова печалба става в пъти по-привлекателна, и пак светът ще почне да се натиска да ги изкупи.

Какво следва от всичко това извратено разбиране ли?

Как да ви кажа, допускам много плавно спускане и на Китай в подобна дългова спирала. Вероятно, и до нови Дълбини.

Коментар