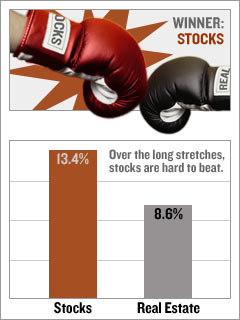

The period from 2001 to 2006 has seen boom periods in real estate, but in the long run, stocks have a tendency to do better. Francisco and Ibbotson in their study have found that in the years 1978 – 2004 the housing sector has annual returns of 8.6% while the commercial sector has annual returns of 9.5%. However, HFI P, a hedge fund of funds, earned significant better 13.4%. Other quotes experts, Robert Shiller for example, expect real estate returns will be down to 3%. Anyway, equity REITs which target commercials properties haven’t disappointed either with returns of 14.8% which is encouraging.

Construction companies in Pakistan have also seen opportunities in the commercial sector, reflecting the global trend of robust returns in real estate investment.

Construction companies in Pakistan have also seen opportunities in the commercial sector, reflecting the global trend of robust returns in real estate investment.

Коментар